Page 210 - ICDEBI2018

P. 210

International Journal of Trend in ScientificInternational Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456Research and Development (IJTSRD) ISSN: 2456-6470 | IF: 4.101

13. POS-point of sale – Businessman hashas to acquire a Analytics –

point-of-sale (PoS) machine for processing card sale (PoS) machine for processing card 1. Today mobile banking and mobile wallets are Today mobile banking and mobile wallets are

payments from banks with whichwhich they already f fastest growing options in payment industryastest growing options in payment industry

have an existing account. Each machine would have an existing account. Each machine would 2. As per the data of 5 banks in December 2016As per the data of 5 banks in December 2016

have a fixed cost of approximately Rs 13,000 as have a fixed cost of approximately Rs 13,000 as A. NEFT, CTS, NACH and cards account for , NACH and cards account for

well well as as monthly monthly rentals rentals of of 500-600. bulk of transactions by volume (76%)of transactions by volume (76%)

Additionally, there would be an RBIAdditionally, there would be an RBI-mandated B. RTGS, NEFT, CTS accCTS account for (89%) of

merchant discount rate (MDR), which a merchant merchant discount rate (MDR), which a merchant transactions by value.

is charged for processing card transactions ssing card transactions 3. It is clear that increased smart phonesmart phone users in India

w

amounting to 0.75-1 % and 2and 2-2.5 % per will grow digital baking in India ill grow digital baking in India National

transaction on debit and credit cards respectively. transaction on debit and credit cards respectively. A

Automated Clearing Houseutomated Clearing House, or NACH, introduced

A key feature of devices today is their A key feature of devices today is their by National Payments Corporation of IndiaNational Payments Corporation of India, is a

centralised clearing service that aims at providing entralised clearing service that aims at providing

‘interoperability’, which means they are able to ‘interoperability’, which means they are able to c

accept not just card payments, but also UPIaccept not just card payments, but also UPI-based interbank high volume, low value tnterbank high volume, low value transactions that

i

payments, transfers from net banking, and ‘tapments, transfers from net banking, and ‘tap- a

are repetitive and periodic in nature. Offering re repetitive and periodic in nature. Offering

credit and debit service to redit and debit service to corporate, banks, and

to-pay’ methods, e-wallets, Aadharwallets, Aadhar-enabled c

payments (AEPS) using near-field communication field communication financial institutions, exponentially.exponentially.

(NFC) technology. 4. Mere technological advancement will not shift the Mere technological advancement will not shift the

14. BHIM – Bharat Interface for money, comparative Bharat Interface for money, comparative t traditional banking pattern to digital banking in raditional banking pattern to digital banking in

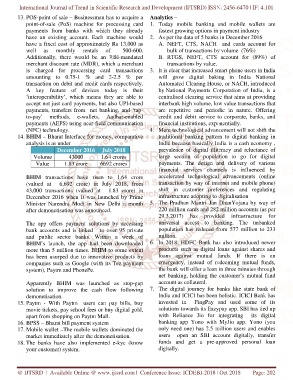

analysis is as under India because basically India is a cash economy , dia because basically India is a cash economy ,

December 2016 July 2018July 2018 prevalence of digital illiteracy and reluctance of revalence of digital illiteracy and reluctance of

p

l

Volume 43000 1.64 crores1.64 crores large section of population to go for digital arge section of population to go for digital

payments. The design and delivery of various ayments. The design and delivery of various

Value 1.83 crore 6692 crores6692 crores p

f financial services channels is influenced by inancial services channels is influenced by

BHIM transactions have risen to 1.64 crore BHIM transactions have risen to 1.64 crore accelerated technological advancements (online ical advancements (online

(valued at 6,692 crore) in July 2018, from 6,692 crore) in July 2018, from t transaction by way of internet and mobile phone) ransaction by way of internet and mobile phone)

shift in customer preferences and regulating hift in customer preferences and regulating

43,000 transactions (valued at 1.83 crore) in 1.83 crore) in s

i

December 2016 when it was launched by Prime December 2016 when it was launched by Prime infrastructure adopting to digitalisationnfrastructure adopting to digitalisation

Minister Narendra Modi in New Delhi a month New Delhi a month 5. The Pradhan Mantri Jan DhanYojana by way of Mantri Jan DhanYojana by way of

220 million cards and 282 million accounts (as per20 million cards and 282 million accounts (as per

after demonetisation was announced.after demonetisation was announced. 2

2

29.3.2017) has provided infrastructure for 9.3.2017) has provided infrastructure for

u

The app offers payment solutions by accessing The app offers payment solutions by accessing universal access to banking. The unbanked niversal access to banking. The unbanked

p

bank accounts and is linked to over 95 private bank accounts and is linked to over 95 private population has reduced from 577 million to 233 opulation has reduced from 577 million to 233

and public sector banks. Within a week of and public sector banks. Within a week of million.

BHIM’s launch, the app had been BHIM’s launch, the app had been downloaded 6. In 2018, HDFC Bank has also introduced newer 2018, HDFC Bank has also introduced newer

p

more than 5 million times. BHIM toBHIM to some extent products such as digital loans against shares and roducts such as digital loans against shares and

has been usurped due to innovative products by has been usurped due to innovative products by loans against mutual funds. If there is an l funds. If there is an

e

companies such as Google (with its Tez payment companies such as Google (with its Tez payment emergency, instead of redeeming mutual funds, mergency, instead of redeeming mutual funds,

system), Paytm and PhonePe. t the bank will offer a loan in three minutes through he bank will offer a loan in three minutes through

n

net banking, holding the customer’s mutual fund et banking, holding the customer’s mutual fund

Apparently BHIM was launched as stopBHIM was launched as stop-gap account as collateral.

solution to improve the cash flow following solution to improve the cash flow following 7. The digital journey for banksfor banks like state bank of

demonetisation. India and ICICI has been holistic. holistic. ICICI Bank has

i

15. Paytm - With Paytm users can pay bills, buy With Paytm users can pay bills, buy invested in FingPay and used some of its nvested in FingPay and used some of its

s

movie tickets, pay school fees or buy digital gold, movie tickets, pay school fees or buy digital gold, solutions towards its Eazypay app. SBI has tied up olutions towards its Eazypay app. SBI has tied up

w

apart from shopping on Paytm Mall.apart from shopping on Paytm Mall. with Reliance Jio for integrating its digital ith Reliance Jio for integrating its digital

banking app Yono with MyJio app. Yono (you anking app Yono with MyJio app. Yono (you

16. BPSS – Bharat bill payment syatem b

only need one) has 2.5 million users nly need one) has 2.5 million users and enables

17. Mobile wallet –The mobile wallets dominatedwallets dominated the o

u

market immediately after the demonetisation. market immediately after the demonetisation. users open an SBI account digitally, transfer sers open an SBI account digitally, transfer

18. The banks have also implemented eThe banks have also implemented e-kyc (know funds and get a pre-approved personal loan approved personal loan

your customer) system. digitally.

@ IJTSRD | Available Online @ www.ijtsrd.comwww.ijtsrd.com | Conference Issue: ICDEBI-2018 | | Oct 2018 Page: 202