Page 129 - ICDEBI2018

P. 129

I International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456nternational Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456-6470 | IF: 4.101

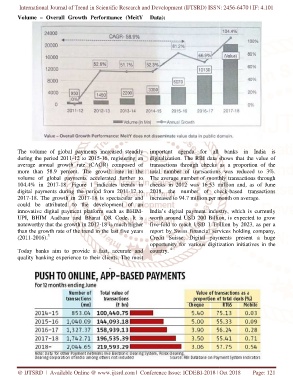

Volume – Overall Growth Performance (MeitY Overall Growth Performance (MeitY Data):

The volume of global payments increased steadily The volume of global payments increased steadily important agenda for all banks in India is important agenda for all banks in India is

during the period 2011-12 to 2015-16, registering an 16, registering an digitalization. The RBI data shows that the value of digitalization. The RBI data shows that the value of

average annual growth rate (CAGR) composed of average annual growth rate (CAGR) composed of transactions through checks as a proportion of the transactions through checks as a proportion of the

more than 58.9 percent. The growth rate more than 58.9 percent. The growth rate in the total number of transactions was reduced to 3%.total number of transactions was reduced to 3%.

volume of global payments accelerated further to volume of global payments accelerated further to The average number of monthly transactions through average number of monthly transactions through

104.4% in 2017-18. Figure 1 indicates trends in 18. Figure 1 indicates trends in checks in 2012 was 16.53 million and, as of June checks in 2012 was 16.53 million and, as of June

digital payments during the period from 2011digital payments during the period from 2011-12 to 2018, the number of check2018, the number of check-based transactions

2017-18. The growth in 2017-18 is spectacular and 18 is spectacular and increased to 94.7 million per month on average.increased to 94.7 million per month on average.

could be attributed to the development of an could be attributed to the development of an

innovative digital payment platform such as BHIMtive digital payment platform such as BHIM- I India’s digital payment industry, which is currently ndia’s digital payment industry, which is currently

UPI, BHIM Aadhaar and Bharat QR Code. It is UPI, BHIM Aadhaar and Bharat QR Code. It is worth around USD 200 Billion, is expected to grow worth around USD 200 Billion, is expected to grow

noteworthy that the growth in 2017-18 is much higher 18 is much higher five-fold to reach USD 1 Trillion by 2023, as per a fold to reach USD 1 Trillion by 2023, as per a

than the growth rate of the trend in the last five years than the growth rate of the trend in the last five years report by Swiss financial services holding company, report by Swiss financial services holding company,

Credit Suisse. Digital payments present a huge redit Suisse. Digital payments present a huge

(2011-2016). 3 C

opportunity for various digitization initiatives in the portunity for various digitization initiatives in the

Today banks aim to provide a fast, accurate Today banks aim to provide a fast, accurate and country. 4

quality banking experience to their clients. The most quality banking experience to their clients. The most

@ IJTSRD | Available Online @ www.ijtsrd.comwww.ijtsrd.com | Conference Issue: ICDEBI-2018 | | Oct 2018 Page: 121