Page 128 - ICDEBI2018

P. 128

I International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456nternational Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456-6470 | IF: 4.101

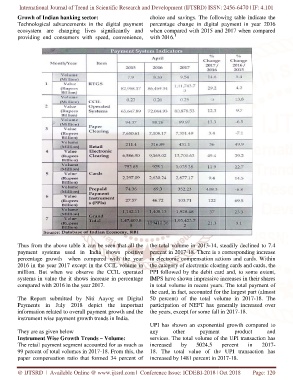

choice and savings. The following tablehoice and savings. The following table indicate the

Growh of Indian banking sector: c

Technological advancements in the digital payment Technological advancements in the digital payment percentage change in digital payment in year 2016 percentage change in digital payment in year 2016

ecosystem are changing lives significantly and ecosystem are changing lives significantly and when compared with 2015 and 2017 when compared when compared with 2015 and 2017 when compared

providing end consumers with speed, convenience, providing end consumers with speed, convenience, with 2016. 1

Thus from the above table it can be seen that all the Thus from the above table it can be seen that all the the total volume in 2013-14, steadily declined to 7.4 14, steadily declined to 7.4

payment systems used in India shows positive payment systems used in India shows positive percent in 2017-18. There is a corresponding increase 18. There is a corresponding increase

percentage growth when compared with the year percentage growth when compared with the year in electronic compensation actions and cards. Within nic compensation actions and cards. Within

2016 in the year 2017 except in the CCIL volume in 2016 in the year 2017 except in the CCIL volume in the category of electronic clearing cards and cards, the the category of electronic clearing cards and cards, the

million. But when we observe the CCIL operated million. But when we observe the CCIL operated PPI followed by the debit card and, to some extent, PPI followed by the debit card and, to some extent,

systems in value the it shows increase in percentage systems in value the it shows increase in percentage IMPS have shown impressive increases in their shares IMPS have shown impressive increases in their shares

compared with 2016 in the year 2017. i in total volume in recent years. The total payment n total volume in recent years. The total payment of

t the card, in fact, accounted for the largest part (almost he card, in fact, accounted for the largest part (almost

The Report submitted by Niti Aayog on Digital by Niti Aayog on Digital 50 percent) of the total volume in 201750 percent) of the total volume in 2017-18. The

Payments in July 2018 depict the important Payments in July 2018 depict the important participation of NEFT has generally increased over participation of NEFT has generally increased over

information related to overall payment growth and the information related to overall payment growth and the the years, except for some fall in 2017the years, except for some fall in 2017-18.

instrument wise payment growth trends in India.payment growth trends in India.

UPI has shown an exponential growth compared to PI has shown an exponential growth compared to

U

They are as given below any o payment ayment p a

product roduct

andnd

other ther

p

s

Instrument Wise Growth Trends – Volume:Volume: services. The total volume of the UPI transaction has ervices. The total volume of the UPI transaction has

percent ercent

The retail payment segment accounted for as much as egment accounted for as much as increased increased b 5 p i in n 2

2017017-

5024.5 024.5

by y

99 percent of total volumes in 2017-18. From this, the 18. From this, the 18. The total value of the UPI transaction has 18. The total value of the UPI transaction has

paper compensation ratio that formed 34 percent of paper compensation ratio that formed 34 percent of increased by 1481 percent in 2017increased by 1481 percent in 2017-18.

@ IJTSRD | Available Online @ www.ijtsrd.comwww.ijtsrd.com | Conference Issue: ICDEBI-2018 | | Oct 2018 Page: 120