Page 116 - ICDEBI2018

P. 116

International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456International Journal of Trend in Scientific Research and Development (IJTSRD) ISSN: 2456-6470 | IF: 4.101

are mainly of two classes: agricultural and are mainly of two classes: agricultural and non- for short and medium-term credit, and term credit, and the other for

agricultural. There are two separate cooperative agricultural. There are two separate cooperative long-term credit.

agencies for the provision of agricultural credit: one agencies for the provision of agricultural credit: one

V. Banking now and then

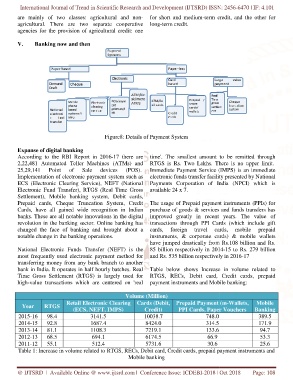

Figure8: Details of Payment Figure8: Details of Payment System

Expanse of digital banking

According to the RBI Report in 2016According to the RBI Report in 2016-17 there are time'. The smallest amount to be remitted through lest amount to be remitted through

2,22,481 Automated Teller Machines (ATMs) and 2,22,481 Automated Teller Machines (ATMs) and RTGS is Rs. Two Lakhs. There is no upper limit.Lakhs. There is no upper limit.

25,29,141 25,29,141 Point Point of of Sale Sale devices devices (POS).(POS). Immediate Payment Service (IMPS) is an immediate Immediate Payment Service (IMPS) is an immediate

Implementation of electronic payment system such as Implementation of electronic payment system such as electronic funds transfer facility presentedelectronic funds transfer facility presented by National

ECS (Electronic Clearing Service), NEFT (National NEFT (National Payments Corporation of India (NPCI) which is Payments Corporation of India (NPCI) which is

Electronic Fund Transfer), RTGS (Real Time Gross Electronic Fund Transfer), RTGS (Real Time Gross available 24 x 7.

Settlement), Mobile banking system, Debit cards, Settlement), Mobile banking system, Debit cards,

Prepaid cards, Cheque Truncation System, Credit Prepaid cards, Cheque Truncation System, Credit The usage of Prepaid payment instruments (PPIs) for The usage of Prepaid payment instruments (PPIs) for

Cards, have all gained wide recognition in Indian Cards, have all gained wide recognition in Indian purchase of goods & services and funds transfers has purchase of goods & services and funds transfers has

banks. These are all notable innovationsnotable innovations in the digital improved greatly in recent years. The value of in recent years. The value of

revolution in the banking sector. Online banking has revolution in the banking sector. Online banking has transactions through PPI Cards (which include gift transactions through PPI Cards (which include gift

changed the face of banking and brought about a changed the face of banking and brought about a cards, foreign travel cards,cards, foreign travel cards, mobile prepaid

notable change in the banking operations.in the banking operations. instruments, & corporate cards) & mobile wallets ts, & corporate cards) & mobile wallets

h

have jumped drastically from Rs.108 billion and Rs. ave jumped drastically from Rs.108 billion and Rs.

National Electronic Funds Transfer (NEFT) is the National Electronic Funds Transfer (NEFT) is the 85 billion respectively in 201485 billion respectively in 2014-15 to Rs. 279 billion

most frequently used electronic payment method for electronic payment method for and Rs. 535 billion respectively in 2016and Rs. 535 billion respectively in 2016-17

transferring money from any bank branch to another transferring money from any bank branch to another

bank in India. It operates in half hourly batches.bank in India. It operates in half hourly batches. Real Table below shows Increase in volume related to Table below shows Increase in volume related to

Time Gross Settlement (RTGS) is largely used for Time Gross Settlement (RTGS) is largely used for RTGS, RECs, Debit card, Credit cards, prepaid card, Credit cards, prepaid

high-value transactions which are centered on 'real value transactions which are centered on 'real payment instruments and Mobile banking:payment instruments and Mobile banking:

Volume (Million)

Retail Electronic Clearing Retail Electronic Clearing Cards (Debit, Prepaid Payment (mPrepaid Payment (m-Wallets, Mobile

Year RTGS

(ECS, NEFT, IMPS)(ECS, NEFT, IMPS) Credit) P Banking

PPI Cards, Paper VouchersPI Cards, Paper Vouchers

2015-16 98.4 3141.5 10038.7 748.0 389.5

2014-15 92.8 1687.4 8424.0 314.5 171.9

2013-14 81.1 1108.3 7219.1 133.6 94.7

2012-13 68.5 694.1 6174.5 66.9 53.3

2011-12 55.1 512.4 5731.6 30.6 25.6

Table 1: Increase in volume related to RTGS, Table 1: Increase in volume related to RTGS, RECs, Debit card, Credit cards, prepaid payment instruments and RECs, Debit card, Credit cards, prepaid payment instruments and

Mobile banking

@ IJTSRD | Available Online @ www.ijtsrd.comwww.ijtsrd.com | Conference Issue: ICDEBI-2018 | | Oct 2018 Page: 108