Page 8 - Special Issue Modern Trends in Scientific Research and Development, Case of Asia

P. 8

International Journal of Trend in Scientific Research and Development (IJTSRD) @ www.ijtsrd.com eISSN: 2456-6470

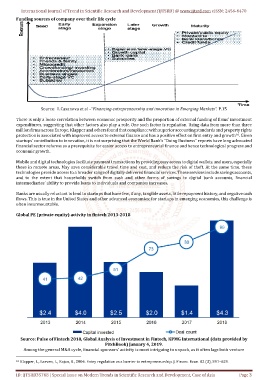

Funding sources of company over their life cycle

Source: L.Casanova et al –“Financing entrepreneurship and innovation in Emerging Markets”. P.15

There is only a loose correlation between economic prosperity and the proportion of external funding of firms’ investment

expenditures, suggesting that other factors also play a role. One such factor is regulation. Using data from more than three

million firms across Europe, Klapper and others found that compliance with superior accounting standards and property rights

protection is associated with improved access to external finance and has a positive effect on firm entry and growth . Given

16

startups’ contribution to innovation, it is not surprising that the World Bank’s “Doing Business” reports have long advocated

financial sector reforms as a prerequisite for easier access to entrepreneurial finance and hence technological progress and

economic growth.

Mobile and digital technologies facilitate payment transactions by providing easy access to digital wallets, and users, especially

those in remote areas, May save considerable travel time and cost, and reduce the risk of theft. At the same time, these

technologies provide access to a broader range of digitally delivered financial services. These services include savings accounts,

and to the extent that households switch from cash and other forms of savings to digital bank accounts, financial

intermediaries’ ability to provide loans to individuals and companies increases.

Banks are usually reluctant to lend to startups that have few, if any, tangible assets, little repayment history, and negative cash

flows. This is true in the United States and other advanced economies; for startups in emerging economies, this challenge is

often insurmountable.

Global PE (private equity) activity in fintech 2013-2018

Source: Pulse of Fintech 2018, Global Analysis of Investment in Fintech, KPMG International (data provided by

PitchBook) January 4, 2019.

Among the general M&A cycle, financial sponsors’ activity is most intriguing to unpack, as it often lags both venture

16 Klapper, L., Laeven, L., Rajan, R., 2006. Entry regulation as a barrier to entrepreneurship. J. Financ. Econ. 82 (3), 591–629.

ID: IJTSRD35768 | Special Issue on Modern Trends in Scientific Research and Development, Case of Asia Page 3